Global crude oil prices are being slashed constantly but the retail prices doesn’t seem to have affected. This is one of the common questions that seem to be playing in the minds of most individuals. There’s a particular economic reason behind this strategic move by the centre.

Handful of people believe that the current government is not very sound when it comes to economic decisions. Let me give you a basic overview with credible data as to how the economy has taken off since 2014, the year when BJP took over at the centre and Narendra Modi became the Prime Minister of India.

Let’s analyse by taking three parameters into consideration starting with the GDP.

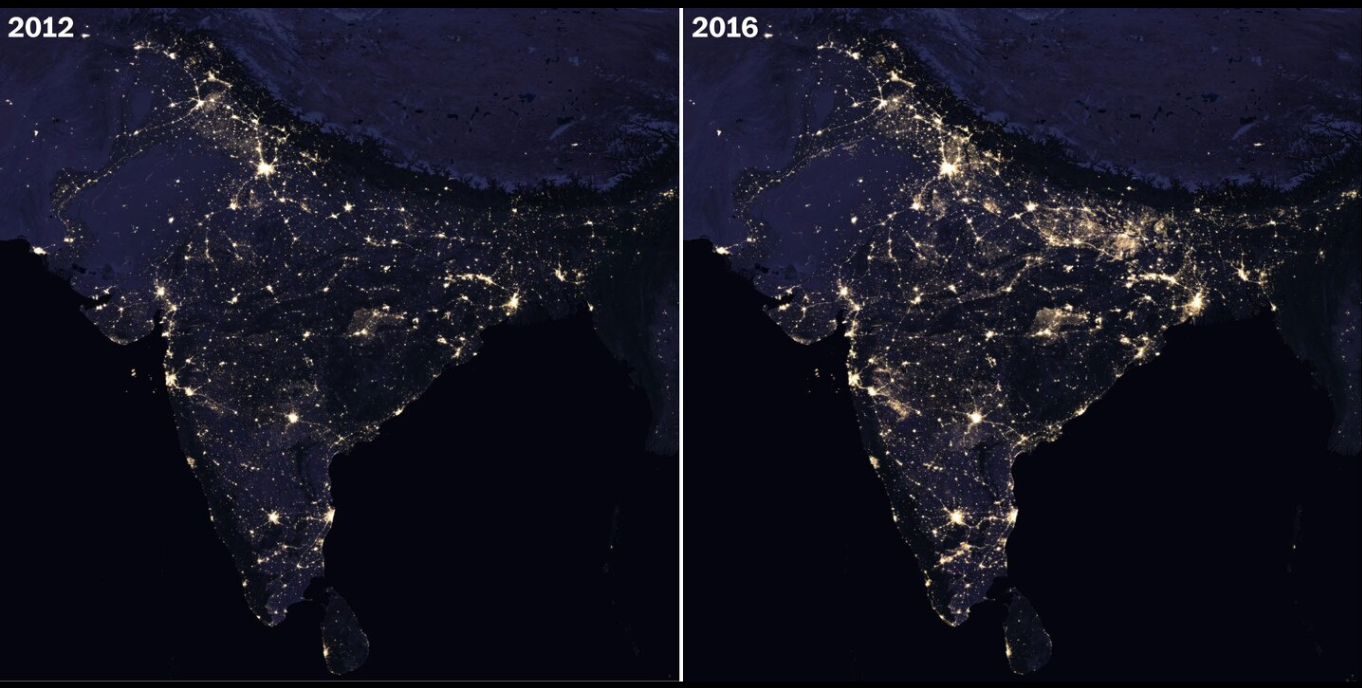

The above picture of India is captured by NASA Satellite during the night. It showcases a clear picture that the electricity consumption increased in the year 2016 as compared to 2012.

The Research paper written by Luis R. Martinez from the University of Chicago shows that increased use of electricity at night is directly attributable to the country’s economic growth. He says, “GDP and nighttime lights provide complementary measures of real economic activity, but while GDP is self-reported by governments and prone to manipulation, night lights are recorded by satellites from outer space and are much less vulnerable.”

Further he states that authoritarian countries like China and Russia manipulate their GDP anywhere between 15 to 30% every year.

When Narendra Modi took over as the Prime Minister of India in the month of May 2014, the GDP of India was about $1.9 trillion. But in October 2014, the IMF released a report which said India to be a $2 trillion economy in 2014. Today, as per the IMF report, India’s GDP stands close to $3.2 trillion and is likely to be the fastest growing economies in the world during the current year.

India joined the Trillion Dollar club in 2007 when for the very first time, GDP crossed $1 trillion. The UPA government, despite being in power for 7 years couldn’t make the GDP touch $ 2 trillion. The Modi government added $1.3 trillion in a span of 5 years.

Second parameter is Inflation.

Inflation can be defined as increase in the prices and reduction in the purchasing power parity.

When there is high inflation, the prices of the commodities and services surges and the purchasing power falls

Inflation in some ways is related to GDP. If a country’s growth is at 10% with 10% inflation, it makes no sense. It’s ideal to have GDP growth rate at 5% with inflation around or less than 2%. The lesser the inflation, the better for the economy as long as it doesn’t turn into nil or negative rate

Let’s look at inflation data since 1998.

From 2004-2014, the UPA government couldn’t control the inflation and hence it was always as high as 8%+, which impacted people’s finances adversely. But ever since the Modi government has taken over the inflation has always been in control. Keeping the inflation low has been the paramount task of the Modi government.

The third and the final parameter, Forex Reserves.

Foreign exchange reserves or Forex reserves are the assets held on reserve by the central bank in foreign currencies These reserves are used to back liabilities and influence monetary policy.

Holding Forex reserves is quintessential for any economy. If India does not have enough Forex reserves, the economy comes to a standstill as it will lack the capability to pay for the external goods and services which it imports.

When the UPA came to power in 2004, our Forex reserves stood at $114 billion and when the Modi Government took over in 2014, it stood at $303 billion. Today, the Forex reserve stands at around $474.660 billion. While the UPA, in 10 years span could add only $189 billion, the Modi government was able to add $172 billion in just 6 years.

GDP is the indicator that says the most about the health of the economy. Optimum level of inflation helps to promote spending to a certain extent instead of saving and maintaining foreign currency reserves is vital to the economic health of a nation.This is the reason why I took these three parameters since it’s vital when it comes to Indian economy. With these three parameters, I hope I was clear enough to showcase the economic expansion that has taken place since 2014.

Now let’s focus on the reason why the Modi government was smart enough to not slash the fuel prices.

When the crude prices crashed, the government decided to give a fraction of benefits to Indian consumers, while the remaining was used to cover the fiscal deficit. Apart from this it’s the oil marketing corporations that keep the prices high and not the government. The deregulation of petrol and diesel has been one of the successful shifts from administered pricing to market determined pricing. Now, since the crude prices crashed, excise duties on both petrol and HSD have been increased to set off the fiscal deficit.

Fiscal deficit basically means the difference between government revenue and government expenditure. India’s budget for the fiscal year 2020-21 included an expenditure of Rs. 30,42,230 crores but the collection in form of revenue was only Rs. 22,45, 893 crores. The difference of Rs. 7,96,337 crores constitutes a fiscal deficit.

To meet the fiscal deficit, the government borrows from the market. The higher the deficit, the more the government has to borrow. This limits the flow of private investment and to discourage people from borrowing, the RBI raises the interest rates.

The above graph demonstrates the consolidated fiscal deficit. As you can see, the UPA government ran a high fiscal deficit which resulted in high inflation. But from 2014, you can observe the curve narrowing around 3% and the inflation being low, as a result. There are obstacles in narrowing it furthermore, the huge chunk of Non Performing Assets left behind by the UPA.

While the UPA was unwise enough to maintain low fuel prices by offering petro-goods subsidies which eventually totaled over Rs. 8,50,000 crores,the Modi government has been smart enough to take optimal advantage of falling crude prices.The low crude oil prices bestows an opportunity to the government to raise money to bridge the fiscal deficit.

Apart from the above advantage, there are multiple factors as to why the petrol prices should be kept high. Back in 2017, R Jagannathan sir had penned down a wonderful article demonstrating various reasons behind it, including how it reduces the terrorism.

Considering all these factors, it’s a bit silly to question the move of the government to tax the petro-goods higher, therefore keeping a check on over consumption of the imported item.

Sources:

https://worldview.earthdata.nasa.gov/?v=65.02837406789605,10.196268700922438,89.04009281789605,20.321268700922438&t=2016-01-01-T00%3A00%3A00Z&l=Reference_Labels(hidden),Reference_Features(hidden),Coastlines(hidden),VIIRS_SNPP_DayNightBand_ENCC(hidden),VIIRS_Night_Lights(hidden),VIIRS_SNPP_CorrectedReflectance_TrueColor(hidden),MODIS_Aqua_CorrectedReflectance_TrueColor(hidden),MODIS_Terra_CorrectedReflectance_TrueColor(hidden),VIIRS_Black_Marble

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3093296

https://www.ceicdata.com/en/indicator/india/consolidated-fiscal-balance–of-nominal-gdp

https://prsindia.org/parliamenttrack/budgets/union-budget-2020-21-analysis

https://www.huffingtonpost.in/varun-parekh/modi-government-made-a-wi_b_9180162.html

https://economictimes.indiatimes.com/news/economy/indicators/india-set-to-become-2-trillion-economy-in-2014-imf/articleshow/44875297.cms?from=mdr

https://www.statista.com/statistics/271322/inflation-rate-in-india/

It was really helpful. Thank you for sharing your knowledge. I look forward to read more stuff like this.

Fantastic goods from you, man. I’ve understand your stuff previous to and you’re just extremely wonderful.

I actually like what you have acquired here, certainly like what

you are saying and the way in which you say it. You make it enjoyable and you

still care for to keep it sensible. I cant wait to read far more from

you. This is actually a great website.