Instruments which provide banks, businesses and the government a mechanism to meet the short term capital needs at a low cost are called money market instruments. It acts as a win-win situation to the borrowers by meeting their short term requirements and to the lenders by providing easy liquidity.

Meaning and Features of Money Market Instruments

(In Text, same as above)

Treasury Bills

- Issued by the Central Government to meet its short term liquidity needs.

- Maturity period of less than 1 year.

- Carried out through primary auction by the Reserve Bank of India (RBI) on behalf of the government.

- Redeemed at face value and issued at discount.

- They can be of three types-91 days/182 days/364 days.

- Negligible default risk

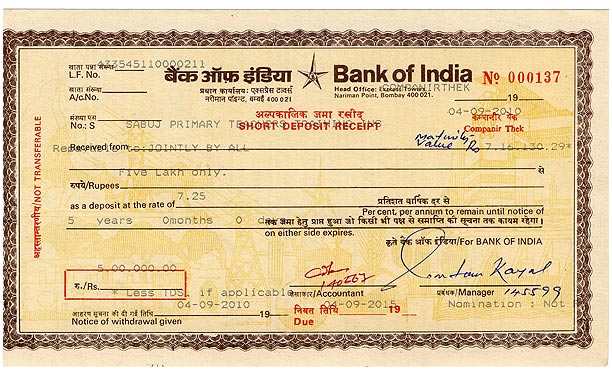

Certificate of Deposits

- Issued by the banks and financial institutions.

- Easily transferable.

- Used for the purpose of Cash Reserve Ratio(CRR) and Statutory Liquidity Ratio(SLR) by the banks.

- Carry low risk and provide higher return compared to treasury bills and term deposits.

- Tenor ranges from 7 days to 1 year.

Commercial Papers

- Unsecured and negotiable instruments.

- Issued by highly rated corporate entities.

- Maturity upto 270 days.

- Corporate entities issuing Commercial paper need to have excellent credit rating from a recognized credit agency.

- Denomination of INR 5 lakhs or more.

Repo

- Parties of the transaction to be approved by the Reserve Bank of India(RBI).

- Collateralised short term borrowing carried out by selling securities with an agreement to repurchase the same securities at a future date at an agreed price.

- Security acts as a collateral to the buyer and buyer earns interest.

- Buyer has an option to sell the securities to a third party incase of default by the seller to repurchase.

Banker’s Acceptance

- Future payment is promised by a bank.

- Assists in eliminating risk if the importer and exporter do not have an established relationship.

- Bank promises to pay the exporting firm the amount specified after recovering the amount from the importer’s account.

- Importer can use Banker’s Acceptance to finance his purchase of goods by presenting a draft to the bank. The bank discounts the draft and provides the cash to the importer. The importer shall repay the amount on or before the maturity date

Excellent article giving a brief of the money market. Can really help a layman to understand the terms. Keep it up.